The team behind the Specialty Coffee Transaction Guide focuses on the impact of the pandemic in new industry tool.

BY CHRIS RYAN

BARISTA MAGAZINE ONLINE

Photos courtesy of the Specialty Coffee Transaction Guide

In the past year-plus, the COVID-19 pandemic has upended our lives and created a new set of challenges for people around the world. Those throughout the coffee industry have been significantly impacted, including coffee producers, who have already faced steep challenges due to low prices and threats from the climate crisis.

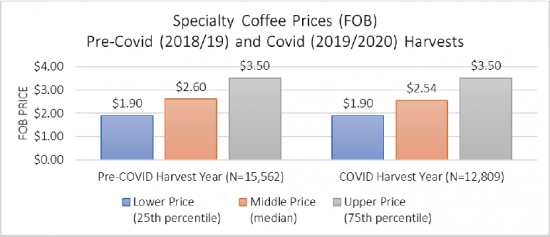

But how exactly has COVID-19 impacted the prices paid for green specialty coffee over the last year? That question is the focus of a newly released report that leverages data from the Specialty Coffee Transaction Guide, the industry tool that earlier this year released its third edition. The answer, in short, is that the pandemic has had a negative overall effect on specialty-coffee sales and a dramatic effect on the composition of those sales.

To be more specific, the report explains that “regular” specialty-coffee sales (coffees scoring less than 84 points according to Specialty Coffee Association cupping protocols and sold in containers) increased in sales, while “fancy” specialty sales (those scoring 84+ points and sold in smaller lots) declined. While these volume and composition shifts indicate the pandemic’s influence, prices (adjusted for quality and quantity differences) actually increased during the COVID-19 harvest year. However, as the report explains, “These increases were not obviously linked to specific supply and demand changes in the specialty market, but to a modest increase in the New York ‘C’ price and large increases in commercial price differentials in various countries.”

The COVID-19 report uses detailed contract data from 58 companies—all of them data donors from the two most recent Specialty Coffee Transaction Guides—to track specific market changes from the last year. The report also relies on information provided during four focus groups, with participants including roasters, producers, exporters, and importers. The report compiles this information to provide a current snapshot of the coffee price situation.

“To uphold our goal of improving and balancing the information environment related to how specialty coffee is transacted, it is critical that we share these insights with the marketplace of specialty-coffee sellers and buyers so that they, in their own ways, can optimize a challenging situation,” says Chad Trewick of Reciprocafé LLC, who worked with Peter W. Roberts of Transparent Trade Coffee, housed at Emory University, to produce both the report and the three Specialty Coffee Transaction Guides.

Chad says that one of the main surprises—and disappointments—about the findings of the report was the aforementioned decline in sales of higher-quality coffees. “This compositional shift in purchasing trends likely means that many of the producers who have worked hard toward high quality and premium prices will find themselves without a market for their coffees—at least temporarily,” Chad says. “This is discouraging when you consider the economic circumstances and aspirations of those coffee producers.”

While the COVID-19 report reveals the pandemic’s effects on the industry so far, Peter and Chad are quick to note that these impacts are still developing as the pandemic continues. “Our focus group participants reminded us that we have (so far) only seen the partial effects of the pandemic,” Peter says. “Given the timing of the different harvests, we need to see what happened later in 2020 and into 2021. Also, many of the possible effects will take time to play out. For this reason, we are committed to a follow-up analysis after we collect the next year of data from our data donors.”

Discussing the pandemic’s continuing effects on coffee pricing, Chad says, “As an industry that likes to have close ties with our supply chain partners, we need to think carefully about what our collective future needs to look like in order to survive, and to come out of this global crisis considering how we must invest toward a much better future. I continue to think that this means placing more and more emphasis on valuing specialty green coffee as a critical raw material to the industry, one that is certainly worth more than it has been selling for over the past several decades.”

The COVID-19 report was supported by Catholic Relief Services, Rainforest Alliance, and TechnoServe’s MOCCA project (funded by the USDA’s Food for Progress program).

To learn more about how the COVID-19 pandemic has influenced green specialty-coffee sales, download the report for free in English or Spanish here.